Smart budgeting tools are essential for managing finances effectively, helping users set goals, track expenses, and enhance financial awareness.

By choosing the right tool and following best practices, individuals can maximise their budgeting efforts and achieve greater financial freedom.

Are you tired of living paycheck to paycheck? Smart budgeting tools can transform your financial health, making it easier to save and invest wisely.

In today’s fast-paced world, managing expenses effectively is crucial.

Understanding Smart Budgeting Tools

Smart budgeting tools are specially designed instruments that help individuals manage their finances efficiently.

They simplify the process of tracking income, expenses, and savings goals all in one place.

Understanding these tools is the first step toward achieving financial stability.

How Do Smart Budgeting Tools Work?

These tools typically link to your bank account, credit cards, or other financial accounts.

They automatically categorize your transactions, making it easy to see where your money is going.

Many also provide visual representations such as graphs and charts, helping you understand your spending patterns better.

Some smart budgeting tools also include features like reminders for upcoming bills, alerts for overspending and savings goals.

These features help you stay on top of your finances and make informed decisions about your spending.

Types of Smart Budgeting Tools

There are various types of smart budgeting tools available. From mobile apps to desktop software, these can cater to different preferences.

Some popular options include:

- Mobile Apps: These allow you to budget on-the-go. Examples include Mint, YNAB (You Need A Budget), and PocketGuard.

- Web-Based Tools: These can be accessed from any computer with internet access. Tools like Personal Capital offer budgeting and investment tracking in one package.

- Spreadsheet Templates: For those who prefer custom solutions, templates in Excel or Google Sheets can provide flexibility in tracking expenses manually.

Choosing the right type of tool can greatly impact your budgeting success.

Why Use Smart Budgeting Tools?

Utilising smart budgeting tools offers several benefits.

Primarily, they foster financial awareness, enabling you to recognize spending habits that may be detrimental to your financial health.

They can help identify areas where you can cut back and save more effectively.

Furthermore, these tools assist in goal setting, whether it be for a vacation, a new car, or retirement.

With better tracking and visual feedback, you can stay motivated and accountable to your financial goals.

Benefits of Using Smart Budgeting Tools

Using smart budgeting tools offers numerous advantages for those looking to gain control of their finances. Here are some key benefits:

1. Financial Awareness

Smart budgeting tools help you understand your spending habits.

By giving you a clear view of your income and expenses, they make it easier to identify areas where you may be overspending or areas that need adjustment.

2. Goal Setting

These tools enable you to set and track financial goals.

Whether you’re saving for a holiday, a new home, or paying off debt, smart budgeting tools help you measure your progress and stay motivated to achieve those goals.

3. Real-Time Tracking

With many smart budgeting tools, transactions are updated automatically in real time.

This immediate feedback allows you to make informed decisions regarding your spending as it happens, rather than waiting until the end of the month.

4. Time-Saving

Manual budgeting can be time-consuming.

Smart budgeting tools automate many of the tasks associated with tracking your finances, significantly reducing the time you spend managing your money.

This efficiency allows you to focus on other important areas of your life.

5. Reduced Financial Stress

By maintaining your budget clearly and simply, these tools help reduce the anxiety that often comes with managing personal finances.

Knowing where your money goes each month gives peace of mind and can lead to better financial decisions.

6. Educative Features

Many smart budgeting tools offer educational resources and tips for users.

These can assist in improving your financial literacy, helping you understand budgeting concepts and best practices so you can manage your money even better.

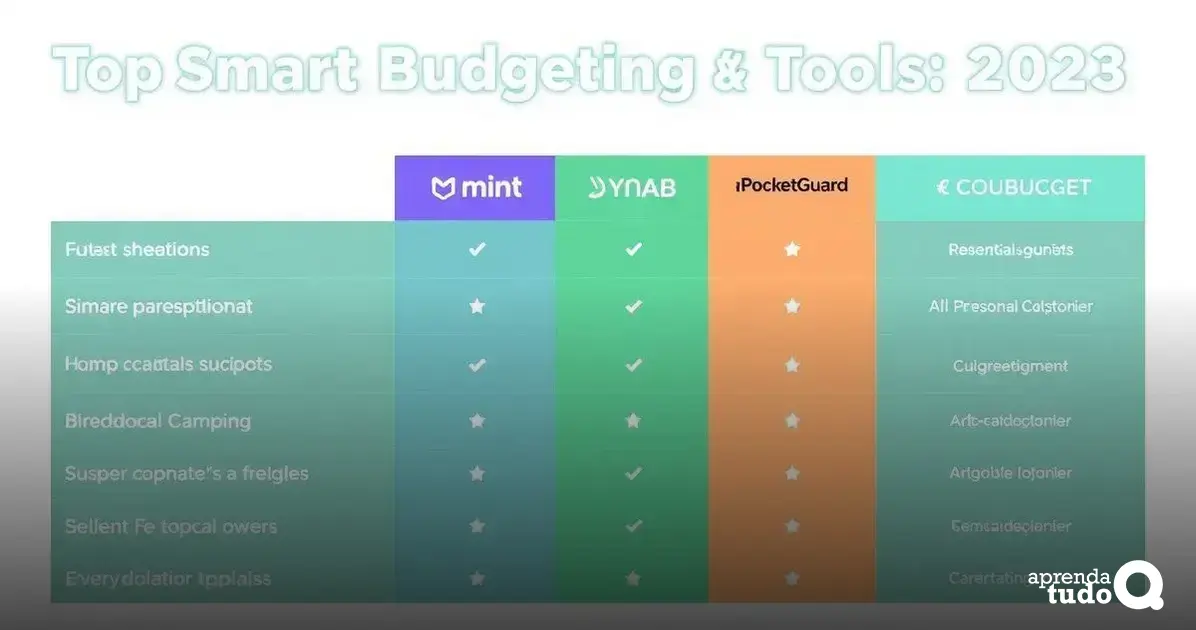

Top Smart Budgeting Tools for 2023

When it comes to managing your finances in 2023, there are several highly-rated smart budgeting tools to consider. Here are some of the best options available:

1. Mint

Mint is one of the most popular budgeting apps available. It allows you to connect all your financial accounts in one place.

Mint automatically categorizes transactions, tracks expenses, and provides a clear picture of your financial health.

Users appreciate the easy-to-read graphs and the ability to set budgets and goals.

2. YNAB (You Need A Budget)

YNAB is focused on helping users take control of their money.

With a goal-driven approach, YNAB teaches budgeting principles that encourage users to plan ahead, ensuring every dollar has a job.

Its mobile app allows for easy updates, and the support community is very active, providing encouragement and advice.

3. PocketGuard

PocketGuard simplifies budgeting by showing how much disposable income you have after covering bills, goals, and necessities.

This makes it easy to see how much you can spend without breaking your budget. The user-friendly interface makes it a great option for those new to budgeting.

4. Personal Capital

Personal Capital offers budgeting features alongside investment tracking.

This dual approach allows users to manage their day-to-day finances while also planning for retirement and long-term financial goals.

The app offers various investment analysis tools that are beneficial for users looking to grow their wealth.

5. EveryDollar

EveryDollar focuses on zero-based budgeting, where your income minus expenses equals zero.

This app is straightforward and user-friendly, making it easy to create monthly budgets. Its premium version has bank syncing to simplify updating your budget.

6. GoodBudget

GoodBudget is an envelope budgeting app that helps users allocate funds for different spending categories.

It’s perfect for those who prefer a traditional cash envelope method but want a digital solution. Users can track their spending and savings, making it easy to stick to their budgets.

How to Choose the Right Smart Budgeting Tool

Choosing the right smart budgeting tool can be the key to successful financial management. Here are some important factors to consider when making your selection:

1. Identify Your Needs

Before choosing a tool, think about what features you need. Do you want automatic transaction tracking?

Are you looking for investment tracking? Make a list of must-have features based on your financial goals.

2. User Interface

The user interface should be easy to navigate. A good tool will have a clear layout allowing you to enter data quickly and see your financial information at a glance.

Test a few tools to see which interface you find most comfortable.

3. Mobile Access

Check if the budgeting tool has a mobile app.

Being able to access your budget on-the-go makes it easier to track spending and make adjustments as needed, especially when you are out shopping or dining.

4. Price

Consider the cost of the tool. Some budgeting tools are completely free, while others require a subscription or one-time payment.

Make sure that the tool you choose fits within your budget while offering the features you need.

5. Reviews and Recommendations

Look for reviews from other users. Real-life experiences can help you gain insights into how effective and reliable a budgeting tool is.

Recommendations from friends or family can also be valuable.

6. Customer Support

Good customer support can be vital when you encounter issues or have questions about the tool. Check if the provider offers support via chat, phone, or email.

7. Scalability

Consider whether the budgeting tool can grow with your financial needs.

As your financial situation changes, you may want a tool that offers additional features or can support more complex budgeting methods.

Tips for Maximising Smart Budgeting Tools

Maximising the use of smart budgeting tools can greatly enhance your financial management skills. Here are some practical tips to get the most out of these tools:

1. Set Clear Goals

Before diving into budgeting, establish what you want to achieve.

Whether it’s saving for a vacation or paying off debt, clear goals give purpose to your budgeting efforts.

2. Regularly Update Your Budget

Consistently update your budget with new expenses and income.

This helps maintain an accurate picture of your finances. Many tools sync with your bank accounts, making updates easier.

3. Categorise Your Spending

Use categories to track your spending habits.

By dividing expenses into groups such as groceries, entertainment, and utilities, you can easily see where your money goes and identify areas to cut back.

4. Review Financial Reports

Most smart budgeting tools generate reports that show your financial behaviour over time.

Regularly reviewing these reports can reveal trends and help you make informed decisions about changes needed.

5. Take Advantage of Alerts

Set up alerts for bills and budget limits. Many budgeting tools offer alerts for when you are close to overspending, helping you stay within your limits and avoid late fees.

6. Use the Mobile App

If your budgeting tool has a mobile app, use it! Having access to your budget on the go makes it easier to track expenses immediately after making a purchase.

7. Be Honest About Spending

Be transparent with yourself about your spending habits. Don’t hide expenses from the budget; include everything for a full picture of your financial situation.

8. Engage with the Community

Many budgeting tools have user communities or forums. Engage with others to share tips, ask questions, and find encouragement.

Being part of a community can provide motivation and new ideas.

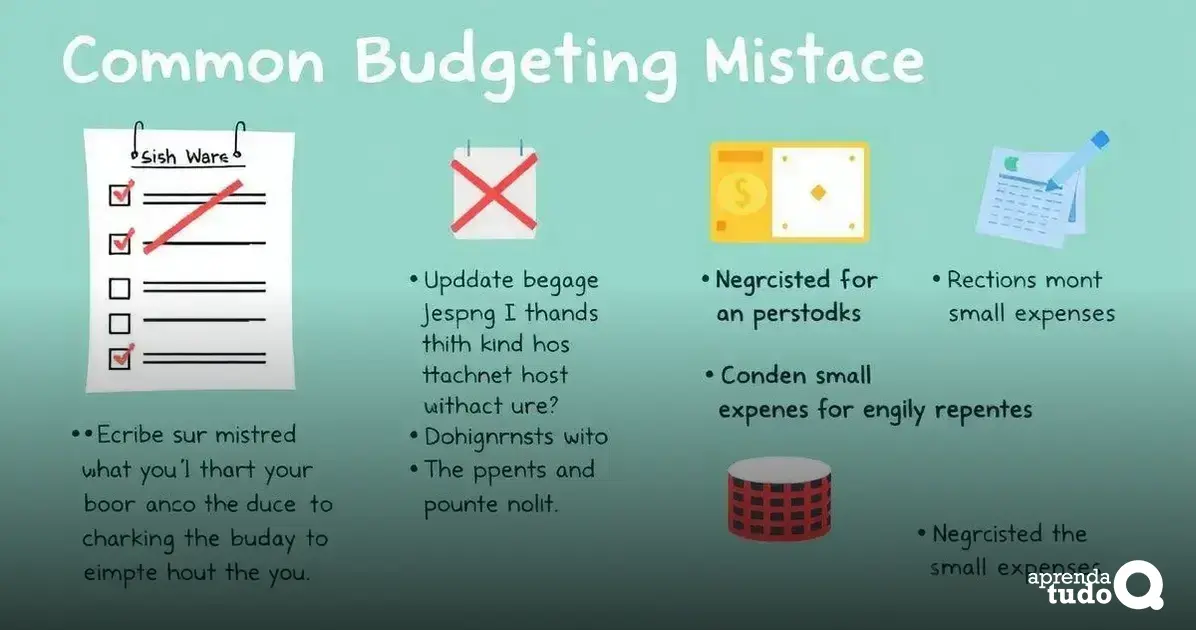

Common Mistakes to Avoid with Budgeting Tools

When using budgeting tools, it’s important to avoid common mistakes that can hinder your financial success. Here are some pitfalls to watch out for:

1. Ignoring Regular Updates

One of the biggest mistakes is not updating your budget regularly.

Without consistent updates, your budget can quickly become inaccurate, causing confusion about your financial situation.

2. Not Setting Realistic Goals

Many people set unrealistically high savings goals. Make sure your goals are achievable within your current financial situation to avoid frustration and disappointment.

3. Overlooking Small Expenses

Small expenses can add up. Ignoring them can lead to budget shortfalls. Always track even the minor costs to get an accurate picture of your spending.

4. Failing to Categorise Expenses

Not categorising your expenses properly can make it hard to monitor and manage your spending. Categories help you see where you’re overspending and where you can cut back.

5. Letting Budgeting Become Overwhelming

Some users attempt to track every single transaction meticulously, which can become overwhelming. Find a balance that works for you, such as tracking major categories instead of every little expense.

6. Skipping Financial Reviews

Do not skip regular financial reviews.

Setting aside time to analyse your spending and budget performance can provide valuable insights and help you make adjustments as needed.

7. Not Taking Advantage of Features

Many budgeting tools offer features that can simplify your budgeting process, such as alerts or reports.

Ignoring these helpful functions can result in missing opportunities to enhance your budgeting experience.

8. Comparing Yourself to Others

It’s easy to fall into the trap of comparing your financial situation with that of others. Everyone’s financial journey is different, so focus on your goals and progress instead.

Embrace Smart Budgeting Tools for Financial Freedom

Utilising smart budgeting tools is a powerful way to take control of your finances and work towards achieving your financial goals.

By understanding the features of these tools and implementing the tips discussed, you can enhance your budgeting experience and avoid common mistakes.

Stay consistent in updating your budget, set realistic goals, and use the available features to your advantage.

Remember, personal finance is a journey, and these tools can guide you through it.

By making informed decisions and regularly reviewing your financial progress, you can unlock a path to greater financial freedom and security.