These community-based savings schemes allow members to pool their resources for various financial goals, such as emergency funds, investment purposes, or social events.

However, managing a stokvel can be challenging due to the complexities of tracking contributions, maintaining transparency, and ensuring accountability.

StokFella, a pioneering digital platform, aims to streamline and modernize stokvel management, making it easier for members to save together effectively.

In this article, we will explore the features, benefits, and transformative impact of StokFella on group savings.

What is StokFella?

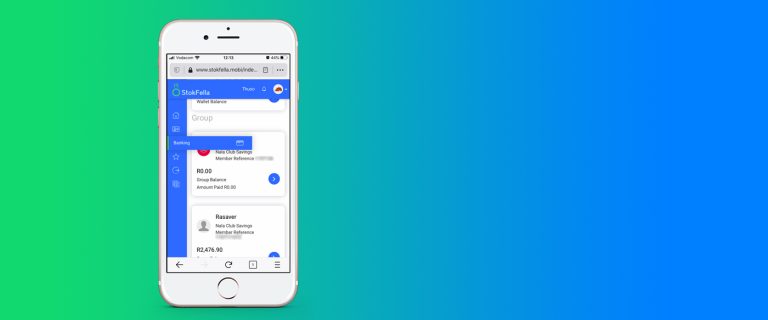

StokFella is a mobile application designed specifically for managing stokvels and other group savings schemes.

It provides a comprehensive suite of tools that simplify the administration of stokvels, from tracking contributions and expenses to facilitating communication among members.

The app is user-friendly and accessible, making it easy for both tech-savvy and less tech-savvy individuals to manage their collective finances efficiently.

Key Features of StokFella

Automated Contribution Tracking

One of the standout features of StokFella is its ability to automate the tracking of contributions. Members can make their payments directly through the app, and StokFella records each transaction in real-time.

This feature eliminates the need for manual record-keeping, reduces errors, and ensures that all contributions are accurately logged.

Expense Management

StokFella also simplifies expense management by allowing administrators to record and categorize expenses within the app.

This transparency ensures that all members are aware of how their pooled funds are being used, fostering trust and accountability within the group.

Financial Reporting

The app provides detailed financial reports that give members a clear overview of the group’s financial status.

These reports include information on total contributions, expenses, and the current balance, helping members make informed decisions about their collective finances.

Secure and Transparent Transactions

StokFella prioritizes security and transparency. All transactions are encrypted and securely processed, protecting members’ financial information.

Additionally, the app’s transparent nature allows all members to view transaction histories, ensuring that everyone is on the same page regarding the group’s finances.

Member Communication and Notifications

Effective communication is crucial for the successful management of a stokvel. StokFella includes a built-in messaging system that facilitates communication among members.

Administrators can send notifications and reminders about upcoming payments or meetings, ensuring that everyone stays informed and engaged.

Goal Setting and Planning

StokFella allows groups to set financial goals and plan accordingly. Whether saving for a specific event, investment opportunity, or an emergency fund, members can track their progress towards these goals within the app.

This feature helps keep the group motivated and focused on achieving their financial objectives.

Integration with Banking Services

StokFella integrates with various banking services, enabling seamless transfers and withdrawals. Members can link their bank accounts to the app, making it easy to deposit contributions and withdraw funds when needed.

This integration adds an extra layer of convenience and efficiency to the group savings process.

Benefits of Using StokFella

Simplified Administration

StokFella significantly reduces the administrative burden of managing a stokvel. The app automates many of the tasks that traditionally require manual effort, such as tracking contributions, recording expenses, and generating financial reports.

This simplification allows administrators to focus on more strategic aspects of managing the group.

Enhanced Transparency and Trust

Transparency is a cornerstone of successful stokvel management. StokFella ensures that all financial transactions are visible to members, fostering a sense of trust and accountability.

This transparency helps prevent disputes and misunderstandings, contributing to a harmonious group dynamic.

Improved Financial Literacy

By providing detailed financial reports and insights, StokFella helps members develop a better understanding of their collective finances.

This increased financial literacy empowers members to make informed decisions, not only within the stokvel but also in their personal financial lives.

Increased Participation and Engagement

The app’s user-friendly interface and communication tools encourage greater participation and engagement from all members.

Reminders and notifications ensure that everyone is aware of their responsibilities and upcoming events, reducing the likelihood of missed payments or meetings.

Time and Cost Efficiency

StokFella saves time and reduces costs associated with traditional stokvel management methods.

The app’s automated features eliminate the need for paper-based record-keeping and reduce the likelihood of errors, saving time and resources for both administrators and members.

Secure and Reliable

Security is a top priority for StokFella. The app uses advanced encryption to protect members’ financial information and ensure that all transactions are securely processed.

This focus on security provides peace of mind for members, knowing that their contributions are safe.

Impact of StokFella on Group Savings

StokFella is transforming the way stokvels operate in South Africa. By leveraging digital technology, the app addresses many of the challenges associated with traditional stokvel management, making group savings more efficient, transparent, and accessible. This transformation has several broader implications:

- Financial Inclusion: StokFella promotes financial inclusion by making it easier for individuals to participate in collective savings schemes. This is particularly important in communities where access to traditional banking services may be limited.

- Economic Empowerment: By facilitating effective group savings, StokFella empowers individuals and communities to achieve their financial goals. This economic empowerment can lead to improved living standards and greater financial stability.

- Community Building: Stokvels are not just about saving money; they are also about building community. StokFella strengthens these community bonds by providing tools that enhance communication, transparency, and trust among members.

- Innovation in Financial Services: StokFella represents a significant innovation in the financial services sector. Its success demonstrates the potential for digital solutions to address real-world challenges and improve financial management practices.

StokFella is revolutionizing group savings in South Africa, offering a modern, efficient, and transparent way to manage stokvels.

By adopting StokFella, groups can streamline their operations, enhance member engagement, and achieve their financial goals more effectively. Download StokFella today and experience the future of group savings.